Renters Insurance in and around Madison

Renters of Madison, State Farm can cover you

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Trying to sift through providers and savings options on top of your pickleball league, keeping up with friends and family events, can be a lot to juggle. But your belongings in your rented townhome may need the impressive coverage that State Farm provides. So when mishaps occur, your pictures, furnishings and furniture have protection.

Renters of Madison, State Farm can cover you

Rent wisely with insurance from State Farm

Why Renters In Madison Choose State Farm

Renters insurance may seem like the last thing on your mind, and you're wondering if it can actually help you. But take a moment to think about how difficult it would be to replace all the possessions in your rented townhome. State Farm's Renters insurance can help when thefts or accidents damage your stuff.

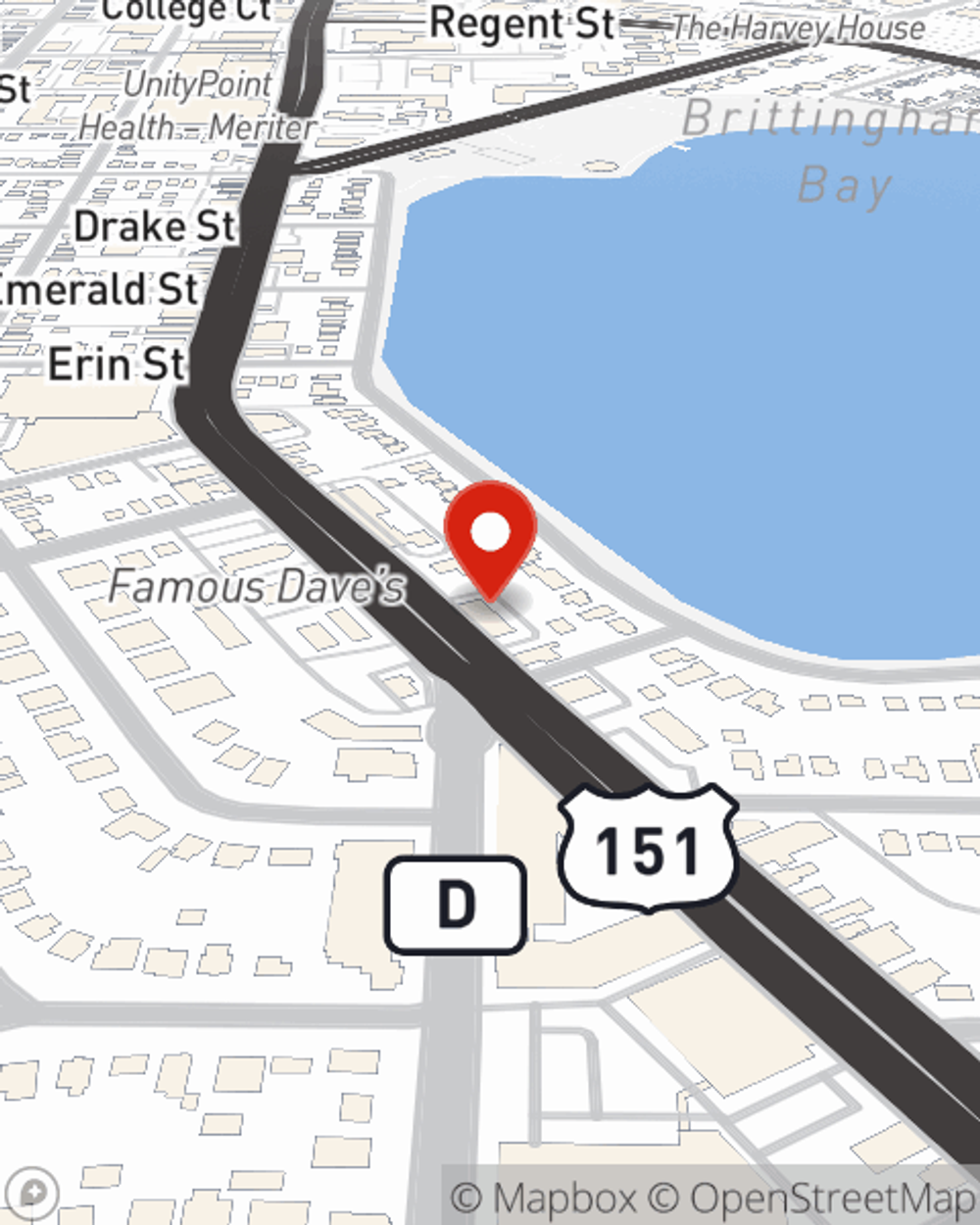

As a reliable provider of renters insurance in Madison, WI, State Farm helps you keep your home safe. Call State Farm agent Alex Rabb today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Alex at (608) 257-5132 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.